TallyPrime 5.1, the latest version of Tally’s powerful accounting software, is set to transform the way you handle your accounts. This edition is packed with innovative features that help organisations streamline operations, improve productivity and assure accurate financial reporting.

From greater GST compliance to better inventory management, this sophisticated solution is designed to suit the changing needs of modern organisations. With advanced functionality and an easy-to-use interface, this latest release enables organisations to improve efficiency, accuracy and compliance.

Let Pearl Computer Lab guide you through the features of TallyPrime 5.1.

Key Features of Tally Prime 5.1

TallyPrime Release 5.1 is a significant update that introduces a range of features designed to streamline. Here are a few of the features explained:

Enhanced GST Compliance with Tally Prime 5.1

Tally Prime 5.1 offers a host of features to streamline GST compliance and reduce the burden of manual tasks.

Bank Charges and GST

One of the most standout changes in TallyPrime 5.1 is the ability to incorporate bank charges in GST filings. Businesses can ensure correct GST calculation and reporting by entering their GSTIN and bank’s state in the bank charge voucher. This eliminates the need for manual adjustments and prevents potential errors.

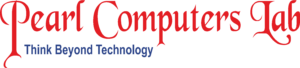

Bulk B2B to B2C Conversion

TallyPrime 5.1 streamlines the process of converting B2B invoices to B2C due to inactive GSTINs. This bulk conversion feature saves time and effort, especially for businesses that handle a high volume of such transactions.

Recomputation of Vouchers

To ensure correct GST computations, TallyPrime 5.1 supports the recomputation of vouchers to reflect changes in masters. This feature is useful when there are changes in GST rates, HSN codes or other relevant parameters. Businesses can ensure that their GST returns are accurate and up to date by recalculating the vouchers.

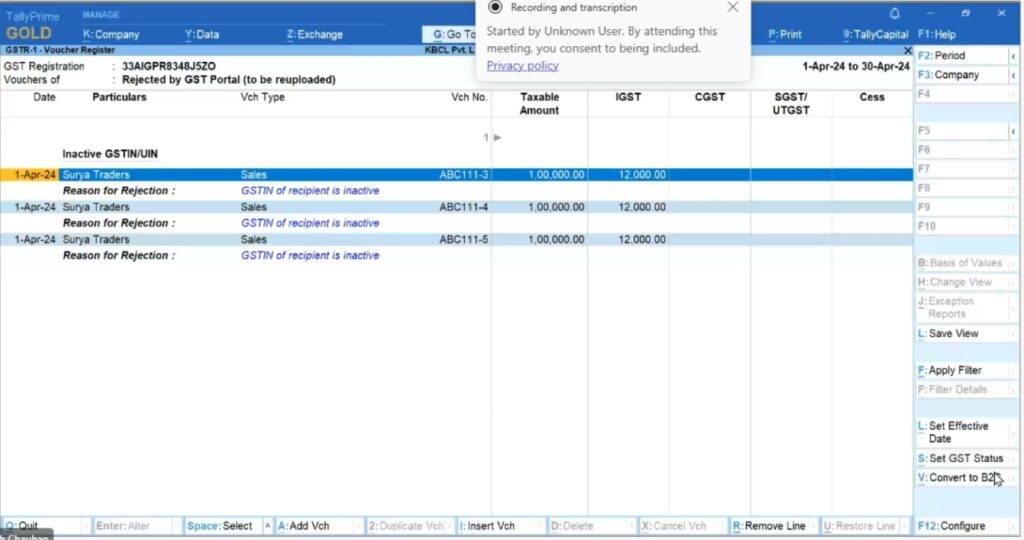

GSTR-2B Compatibility

This allows for simple integration and precise data retrieval. This simplifies the reconciliation procedure for input tax credits and guarantees that firms claim the correct amount of credit.

Improved Eway Bill with Tally Prime 5.1

Tally Prime 5.1 is designed to provide a seamless and efficient user experience with Eway Bill. Here are some of the key points:

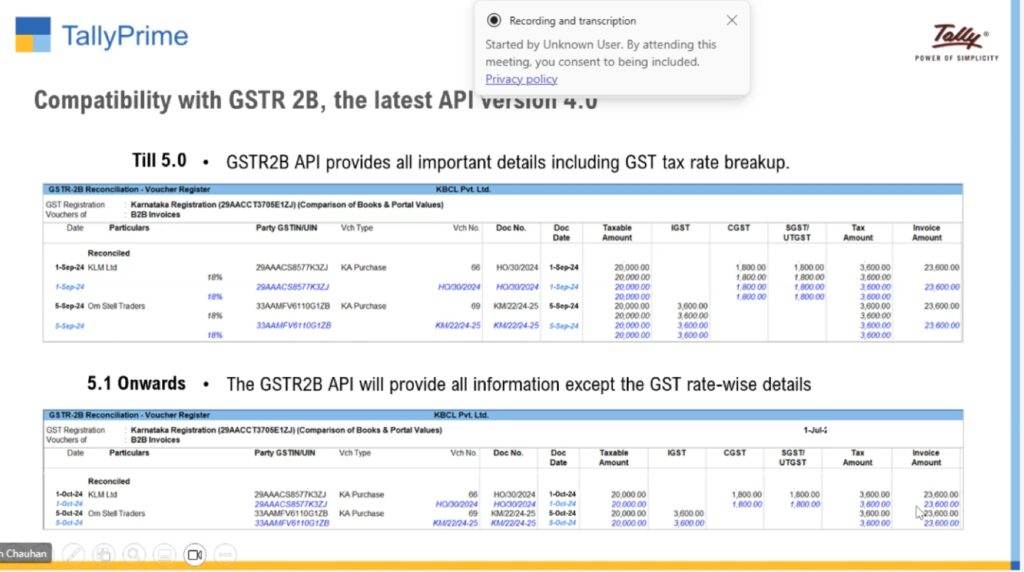

Pin-to-Pin Distance

While generating e-way bills, TallyPrime 5.1 can automatically calculate the pin-to-pin distance based on the provided pin codes, saving time and effort.

Actual Pin and State Selection

You can now select the actual pin code and state in the consignee details of the export invoice, ensuring accurate e-way bill generation.

E-way Bill for Material In and Material Out

Tally Prime 5.1 supports e-way bill generation for both material inward and outward transactions, enhancing compliance.

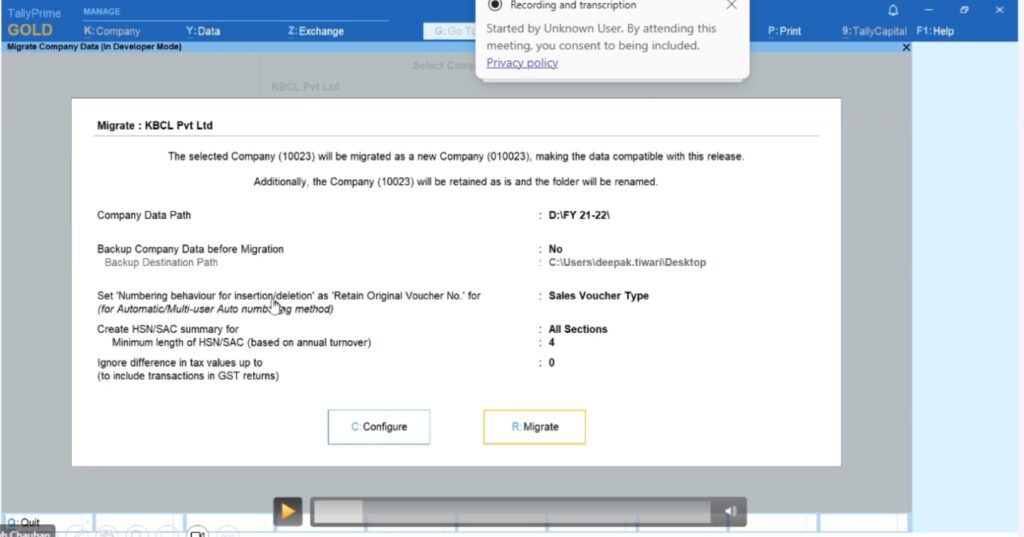

GST Migration Setup and Voucher Numbering in TallyPrime 5.1

In the GST migration, you have the option to retain the numbering scheme for specific voucher types. This feature provides flexibility and control over the migration process, allowing you to maintain consistency in your accounting records. Here’s how it works:

Identify Voucher Types

Determine which voucher types you want to retain the numbering for. This could include sales invoices, purchase invoices, journal entries other relevant types.

Configure Migration Settings

During the migration process, you can specify the voucher types for which you want to retain the numbering. This configuration ensures that the migrated vouchers retain their original numbers.

Benefits of Retaining Numbering

- Continuity: Maintains a seamless transition between the old and new systems, reducing confusion and errors.

- Auditing and Reconciliation: Facilitates easier auditing and reconciliation of financial records.

- Regulatory Compliance: Ensures compliance with GST and other regulatory requirements

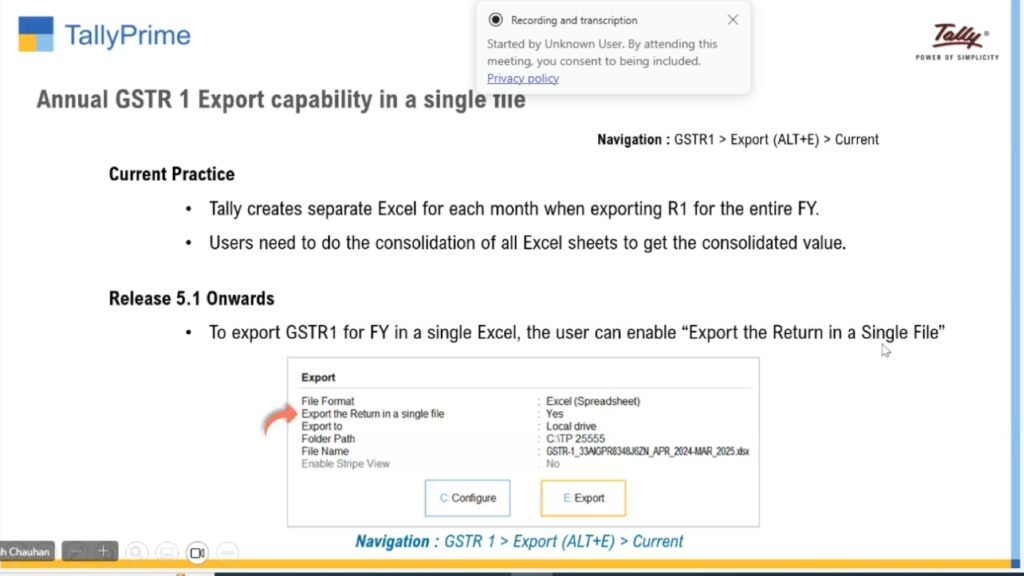

Annual GSTR and Single-File Export in Tally Prime 5.1

Tally Prime 5.1 simplifies the annual GST return filing process by allowing you to export the entire year’s GSTR-1 data into a single file. This significantly reduces the time and effort required to prepare and submit the annual return.

Key Benefits of Single-File Export:

- Efficiency: Streamlines the export process and minimizes the risk of errors.

- Accuracy: Ensures accurate data transfer and reduces the potential for discrepancies.

- Convenience: Simplifies the filing process and saves time.

By utilizing this feature, businesses can efficiently comply with annual GST return filing requirements and focus on other critical aspects of their operations.

Conclusion

TallPrime 5.1 is a powerful accounting software that offers a wide range of features to streamline business operations and improve financial management. From enhanced GST compliance to advanced inventory management and robust financial reporting, this software has everything you need to succeed.

If you’re looking to take your business to the next level, consider upgrading to Tally Prime 5.1. With its user-friendly interface, powerful features and seamless cloud integration, this software is the perfect solution for businesses of all sizes.

Pearl Computer Labs is here to help you make the most of TallyPrime 5.1. We offer expert guidance and support to help you maximize the benefits of Tally Prime 5.1. Contact us today to learn more about our services and how we can assist you in implementing this powerful software.